27 May How To Trade Cryptocurrency

Trading cryptocurrency is a great way to make passive income. Learn how to trade cryptocurrency in this comprehensive guide!

With the price of Bitcoin and other cryptocurrencies on the rise, now is a good time to start trading cryptocurrency. However, if you’re not familiar with the world of cryptocurrency, it can be difficult to know where to start.

One option is to try swing trading, which allows you to take advantage of swings in the market without having to be glued to a screen all day. Read on to find out more!

What Is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security. It is not backed by any central authority, and its value is determined by market forces.

This technology is decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Often traded on decentralized exchanges, it can be used to purchase goods and services. Some major retailers, such as Overstock accept crypto as payment.

Cryptocurrencies are sometimes associated with illegal activity, as they can be used to anonymously purchase items on the dark web.

However, they have also gained mainstream adoption and are becoming more accepted as a legitimate form of payment.

What Is Crypto Trading?

Crypto trading is the process of buying and selling digital assets to profit from price changes. These currencies are traded on decentralised exchanges, which are platforms that allow users to buy and sell without the need for a central authority.

Trading is usually against other crypto or fiat currencies, such as the US dollar. It’s still a relatively new activity and has become increasingly popular in recent years as the prices of Bitcoin and other digital assets have skyrocketed.

This is considered a risky activity, and it’s important to understand the market before putting any money at risk.

However, for those who are willing to take on the risk, crypto trading can be a highly profitable activity.

Types Of Trading

When it comes to crypto trading, there are many different approaches that traders can take. Some common types of trading include swing trading, day trading, breakout trading, contrarian trading, short selling, and long selling.

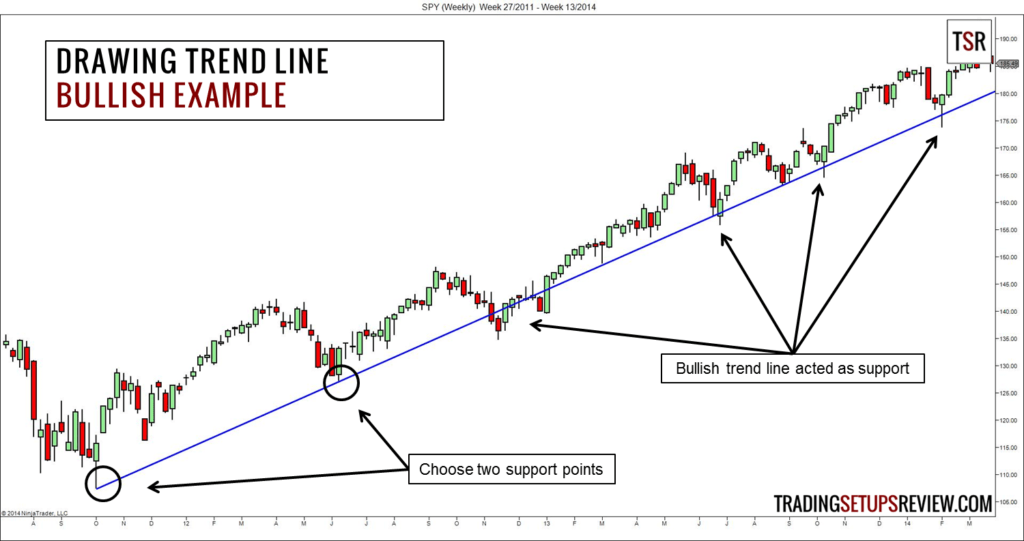

Swing trading involves holding a position for some time to profit from price swings. Day trading involves taking multiple positions throughout the day and then closing them all out at the end of the day. Breakout trading involves buying or selling when the price breaks out above or below a certain level. Contrarian trading involves taking a position that is contrary to the current trend.

Short selling involves selling a security that you do not own and then buying it back at a lower price to profit from the price difference. Long selling involves buying a security to sell it at a higher price in the future.

Each of these approaches has its own benefits and risks, so it’s important to choose an approach that best suits your goals and risk tolerance.

If you’re looking to trade with a full-time job, I recommend swing trading. This is ideal because you usually hold trades from one day to three months, therefore you don’t have to sit at computer all day long.How To Trade Crypto

When it comes to getting started in the world of trading, there are a few options available. For those who are just starting, or who want to get a feel for the market before committing any real money, paper trading can be a good option. This involves making trades with fake money to get a sense of how the market works and how to execute trades. For those who are ready to start trading with real money, however, it is important to get an education first. This will help you find an edge in the market and be profitable in the long term. There are several ways to get an education in trading, but one option is to find a mentor who can provide you with guidance and daily market analysis videos. Another option is to take courses from a reputable trading school such as TTG or ITMS. Whichever route you choose, getting an education in trading is an important step toward becoming a successful trader. Here’s a link to my Free Crypto Telegram Channel, I share tonnes of trading ideas!Find A Brokerage

When you’re trading cryptocurrencies, it’s important to choose a broker that is trustworthy and has a good reputation. There are a few things to look for when choosing a broker, such as regulatory compliance, fees, ease of use, and customer support.

One of the most important things to consider is whether the broker is regulated by a financial authority. This will help to ensure that the broker is following certain guidelines and is not engaged in any illegal activity.

It’s also important to compare the fees charged by different brokers before making a decision. Some brokers may charge higher fees for trading, but offer other benefits such as higher levels of customer support.

Finally, it is also worth considering how easy the broker’s platform is to use. Some platforms can be very complicated, making it difficult to trade successfully. By taking all of these factors into account, you can be sure to find a crypto broker that suits your needs.

For crypto trading my preferred broker is Bitfinex.Technical Analysis

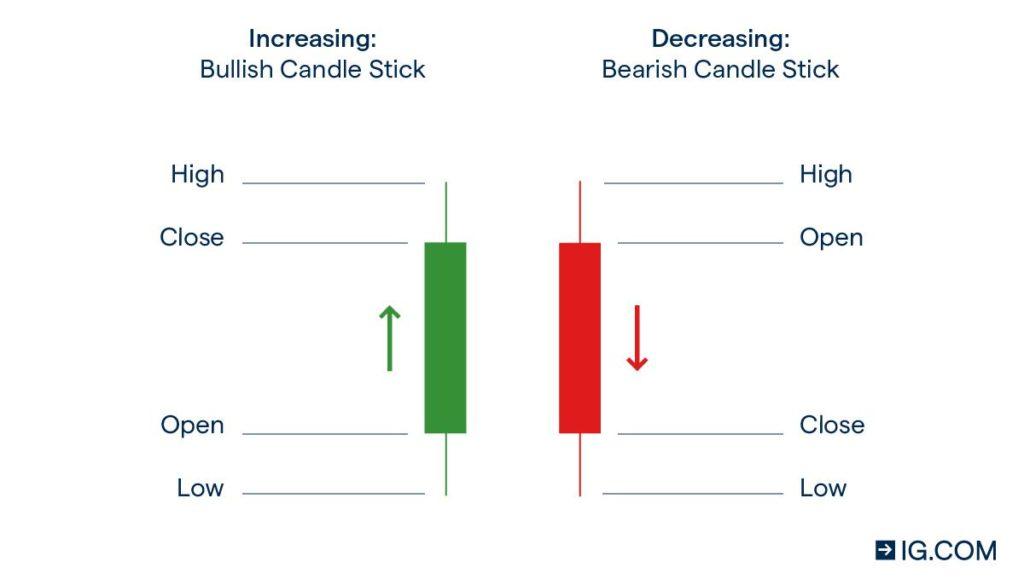

One popular form of technical analysis is the use of candlestick charts. These charts are used to track the price movements of a security over time, with each candlestick representing the price action for a single day. Candlestick patterns can provide valuable insights into market trends, and many traders use them to make decisions about when to buy and sell.

Fundamental Analysis

Crypto trading can be a complex and daunting task for even the most experienced investor. However, by understanding the basics of fundamental analysis, traders can simplify the process and make informed decisions about which coins to buy and sell.

One of the key considerations is market capitalisation, which refers to the total value of all outstanding coins. Coins with a low market cap are more volatile and prone to manipulation, making them a less attractive investment.

Instead, traders should focus on the top 20 coins by market capitalisation, as these are more likely to maintain their value over time. With a clear understanding of the fundamentals, crypto trading can be a profitable and rewarding experience.