24 May 9 Steps To Trading Stocks With A Chronic Illness

Trading stocks can be a great way to make money if you have a chronic illness. Here are nine steps to get started!

There were many years when I was bedridden with a chronic illness, living on a disability pension and the last thing on my mind was making money. As the years passed I slowly improved to the point where I am making several grand a month trading stocks.

Making money is hard enough when you are healthy, but it can be even more difficult when you have a chronic illness or disability. Trading stocks can be a great way to make some extra income, but it can be difficult to do if you don’t have the energy or ability to. In this blog post, we will discuss how to trade stocks from the comfort of your own home!

1. What Is Stock Trading?

The first step to trading stocks with a chronic illness is to understand what it is. You may be wondering what the difference is between trading and gambling? Essentially, it comes down to education and finding a strategy that works.

Gambling relies on luck, while trading relies on skill and understanding of the market. A good trader will have a strategy that they follow religiously, which gives them an edge over those who are simply hoping for a lucky break.

A successful stock trading career requires dedication and a willingness to learn, but it can be extremely rewarding. With the right approach, you can make a lot of money by capitalising on market fluctuations. If you’re willing to put in the work, stock trading can be a great way to earn a living.

2. Types Of Stock Trading

When it comes to stock trading, there are many different approaches that traders can take. Some common types of stock trading include swing trading, day trading, breakout trading, contrarian trading, short selling, and long selling.

Swing trading involves holding a position for some time to profit from price swings. Day trading involves taking multiple positions throughout the day and then closing them all out at the end of the day. Breakout trading involves buying or selling when the price breaks out above or below a certain level. Contrarian trading involves taking a position that is contrary to the current trend.

Short selling involves selling a security that you do not own and then buying it back at a lower price to profit from the price difference. Long selling involves buying a security to sell it at a higher price in the future.

Each of these approaches has its own benefits and risks, so it’s important to choose an approach that best suits your goals and risk tolerance.

3. How To Trade Stocks With A Chronic Illness

When it comes to getting started in the world of trading, there are a few options available. For those who are just starting, or who want to get a feel for the market before committing any real money, paper trading can be a good option. This involves making trades with fake money to get a sense of how the market works and how to execute trades.

For those who are ready to start trading with real money, however, it is important to get an education first. This will help you find an edge in the market and be profitable in the long term. There are several ways to get an education in trading, but one option is to find a mentor who can provide you with guidance and daily market analysis videos.

Another option is to take courses from a reputable trading school such as TTG or ITMS. Whichever route you choose, getting an education in trading is an important step toward becoming a successful trader.

Here’s a link to my Free Crypto Telegram Channel, I share tonnes of trading ideas!

4. Find A Brokerage

When looking for a brokerage, it is important to consider its FDIC insurance status. This will protect your investment in the event that the brokerage goes out of business. It is also important to consider whether the brokerage offers a wide variety of stocks and ETFs to choose from.

This will allow you to diversify your portfolio and reduce your risk. Finally, it’s also important to consider whether the brokerage offers short selling. This will allow you to profit from falling stock prices. Two brokerages that meet all of these criteria are Interactive Brokers and Tradestation. For Crypto trading my preferred broker is Bitfinex.

5. Technical Analysis

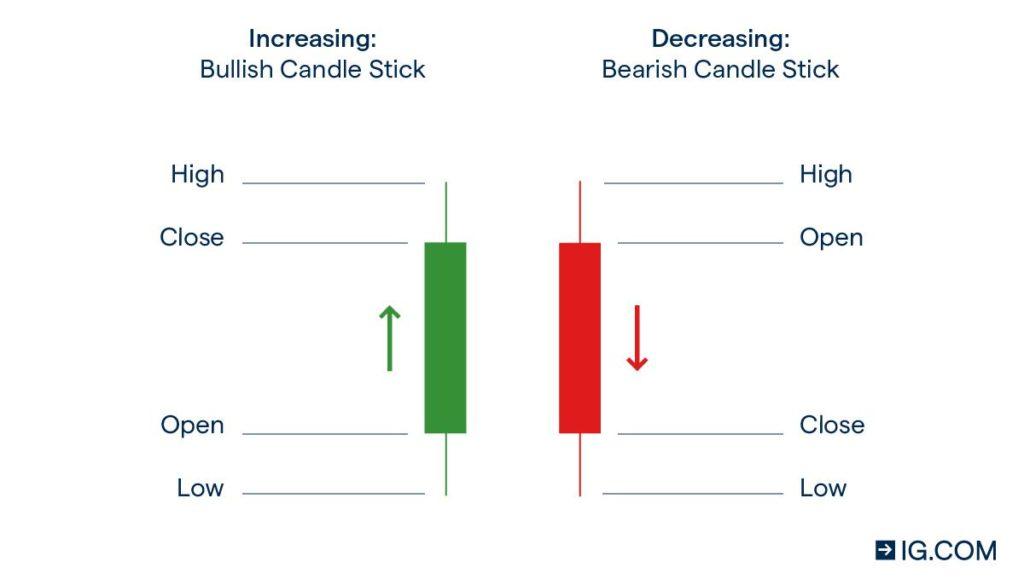

One popular form of technical analysis is the use of candlestick charts. These charts are used to track the price movements of a security over time, with each candlestick representing the price action for a single day. Candlestick patterns can provide valuable insights into market trends, and many traders use them to make decisions about when to buy and sell stocks.

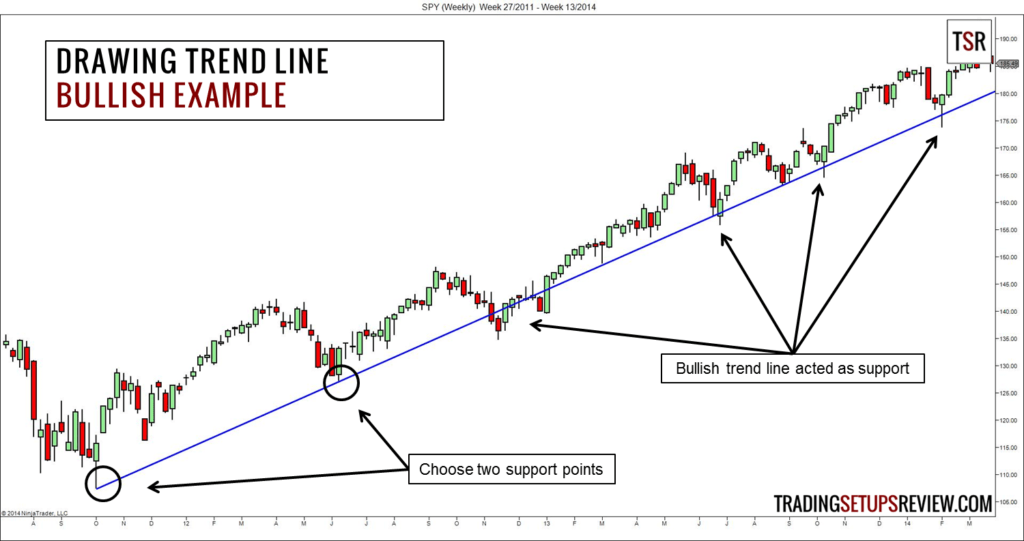

Trend lines are another important tool for technical analysis. These lines are drawn on charts to connect price points and reveal the overall direction of a market. By spotting emerging trend lines, traders can often get an early indication of where the market is headed.

By using these and other technical analysis tools, traders can gain a better understanding of market conditions and make more informed decisions about their trading strategies. My favourite charting software is TradingView.

6. Risk Management

When it comes to risk management in trading, the general rule of thumb is to only trade with money that you can afford to lose. This may seem like an obvious statement, but it’s often overlooked by novice traders who get caught up in the excitement of the markets.

By only trading with a small amount of capital, you’ll be less likely to make impulsive decisions that are driven by your emotions. Instead, you’ll be able to approach each trade with a clear and objective mindset.

While there is no guaranteed way to avoid losses, risk management is an essential part of successful trading. By following this simple rule, you’ll put yourself in a much better position to succeed in the long run.

7. Paper Trading For Beginner Traders

Before I started trading on the stock market, I tried my hand at paper trading. This is where you trade with fake money to learn the ropes and get a feel for how the market works.

While it was helpful to have a simulated version of the market to learn from, I found that it wasn’t as exciting or engaging as trading with real money. This is because there is no real risk involved in paper trading, so it doesn’t give you the same adrenaline rush that comes with making a real trade.

For me, this made paper trading feel less like actual investing and more like a game. As a result, I decided to start trading with real money so that I could get the full experience. And while there have been some bumps along the way, I’m glad I made the switch.

Paper trading is a great way to learn the basics, but nothing can replace the feeling of putting your money on the line and making a real profit.

8. Types Of Market Orders

Several different types of market orders can be placed with a broker. A stop-loss order is an order to buy or sell a security when it reaches a certain price and is typically used to limit losses.

A limit order is an order to buy or sell a security at a specific price and is used to ensure that a trade is executed at the desired price. A sell limit order is an order to sell a security at a specified price and is typically used when trying to take profits.

A buy order is an order to buy a security at a specified price and is typically used when trying to enter a position. Short selling is the sale of a security that the seller does not own, and is typically used when expecting the price of the security to fall.

No matter what type of market order you are looking to place, it’s important to work with a broker that you can trust.

9. Different Markets

When it comes to investing, there are a variety of different markets to choose from. In the United States, the two most popular options are the NASDAQ 100, which consists of the top 100 companies, and the S&P 500, which includes the top 500 companies. For investors looking for even more options, there is also the Russel 2000, which includes the top 2,000 companies.

In addition to these markets, several international markets can be traded. Some of the most popular options include the ASX 200 in Australia, the Nifty 50 in India, the Kospi 200 in Korea, and the Hang Seng in Hong Kong.

For those looking to invest in something open 24/7, cryptocurrency is an option. No matter what type of market you choose to invest in, it is important to do your research and understand the risks involved.

In Conclusion

Trading with a chronic illness can be a difficult endeavour, but if you approach it with consistency, persistence, and discipline, you can find ways to make profits. The stock market is constantly changing, and it can be tough to keep up with the latest trends.

However, if you stay informed and make smart decisions, you can earn money from your trades. Additionally, it is important to remember that losses are inevitable in trading. Do not let setbacks discourage you; instead, use them as learning opportunities.

If you keep these things in mind, you can succeed as a trader. Even on my worst days I couldn’t get out of bed, I still managed to trade from my phone!